Risk Transference is a strategy used by a company, business or organization to transfer the risk or threat of loss, injury, or damage it anticipates to a third party. The third party is therefore tasked with taking responsibility for the liabilities of the company. This strategy to manage and control risk is beneficial to the organization as it can concentrate on its core business mandate though at a cost.(PMBOK®, 6th edition, ch. 11.2.3.2).

How Risk Transference Works

Risk Transference is a voluntary agreement between the company owning the risk and the third party contracted to mitigate or cover the risk. The company seeking to transfer the risk approaches a third party to get covered and get into a mutual agreement by signing a contract or purchasing an insurance policy.

The company taking up the insurance policy is then mandated to make periodic payments in the form of premiums to honor the responsibility being undertaken by the third party. The third party, which must have the capacity and ability to insure and or control the risk, then assumes the obligation to cover the potential liability. While there is a possibility that this risk may not take place, the insured company has the benefit of concentrating on its core business mandate.

Risk Transference Example

The best form of risk transference is notably in the insurance industry, where an individual takes cover for an asset and pays premiums for it. Here is an example:

Luke Brown has taken an insurance cover worth $5000 for his vehicle, which is meant to cover any form of physical damage. He is going to pay the agreed premiums for one year. Supposing Luke’s vehicle develops or gets any physical damage and repairs the car for $1000, he will lay claim for the $1000 from the insurance company.

Benefits of Transferring Risk

Risk transference carries a lot of benefits, especially for the company or individual seeking to transfer the risk. Some of the benefits include the following:

• It safeguards and protects the company’s assets from any threats that may be unforeseen.

• It shields the company from any financial losses associated with the risk to the extent of the policy agreement.

• By making periodic payments in small amounts, the company is saved from more significant financial burdens.

• The terms and nature of the agreement are not subject to the changing market conditions.

Disadvantages of Transferring Risk

• The risk transfer comes as an additional expense to the asset owner

• The risk coverage is most times limited

• The company covering the risk should always be solvent

Types of Risk Responses for Threats

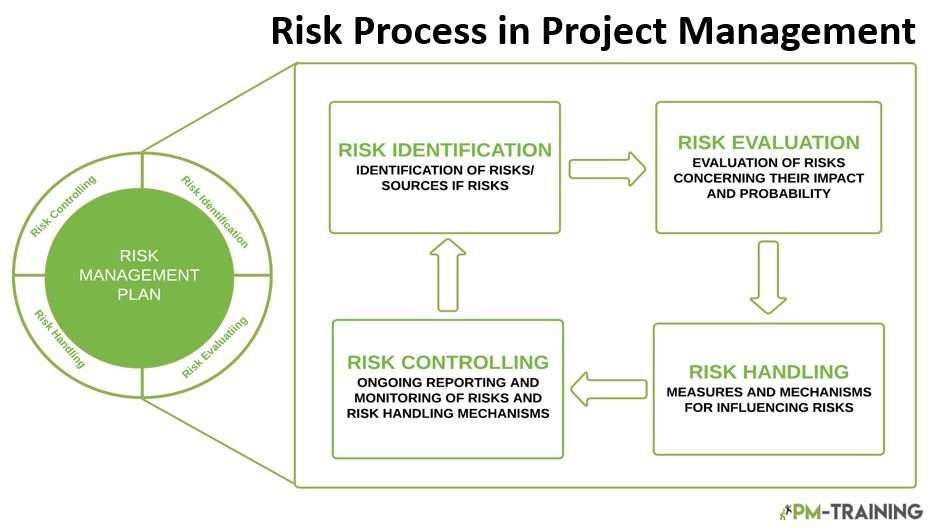

When handling any project, it is crucial to understand that several risks are involved, whether expected or not. In order to safeguard and prepare your projects for success, you need to plan on the risks and threats and determine how to handle them if and when they occur.

Risk response can therefore be defined as the process undertaken by a company to control the risks it has identified within its projects. (PMBOK®, 6th edition, ch. 11.5.2.7). Therefore, it is vital that you identify, quantify, and rank the risks in order of severance and probability of happening.

You can use the formula: Risk = Risk Probability * Severity.

Once you have quantified and prioritized the risks, here are risk responses you can implement to manage your project risks.

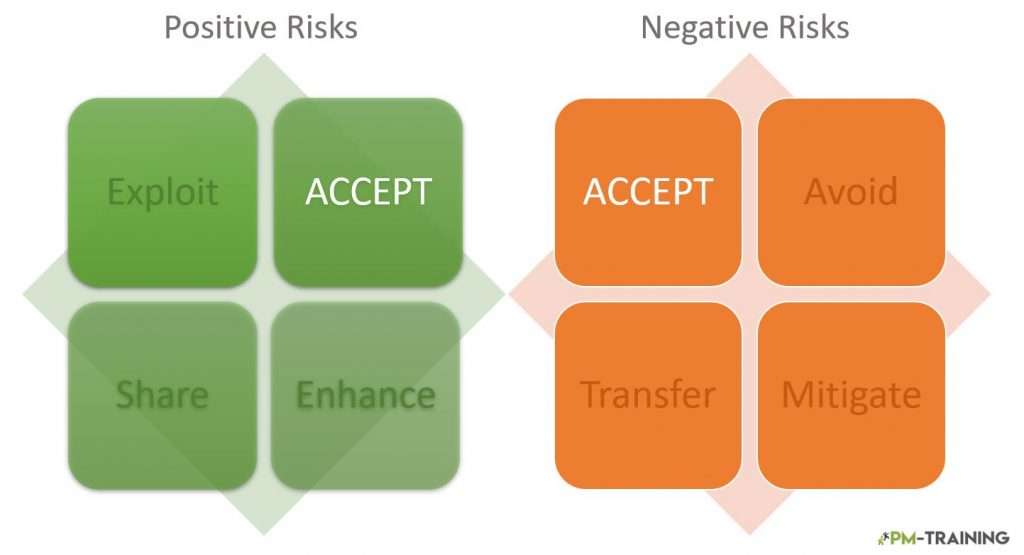

Risk Avoidance

Risk avoidance is among the easiest ways for an individual or company to remove risks associated with handling projects. It is not always possible to do so since it requires the removal of those project tasks related to the threat. While not all the risks can be removed, some may be costly since they involve changing the project’s scope, timing, resources, and human resources. It is therefore essential to conduct a cost-benefit analysis on the risks you intend to remove.

This risk response strategy is primarily implemented when the risk carries significantly negative consequences that are not within the project’s thresholds. In extreme cases, risk avoidance may entail the cancellation of the entire project if the risk threshold is unaccepta

Example of Risk Avoidance vs. Transfer

In risk avoidance, an extreme sports enthusiast understands the risk of injury and stops participating in the sport altogether. In risk transfer, the individual decides not to stop the sport but goes ahead and signs up for a cover in case of injury, thereby transferring the risk to the third party company.

Risk Mitigation

Risk mitigation involves reducing the impact of risks that you cannot eliminate. There are effective steps that one can implement to mitigate risks. The first is to reduce the probability of the risk occurring by developing strategies to prevent the threat. The second way to minimize the risk is to reduce the severity of the risk, especially on the project success factors when it occurs. (PMBOK®, 6th edition, ch. 11.5.2.5).

Some of the few methods you can consider include conducting additional tests, reducing process and operation complexities, and conducting personnel training. Another option project managers can implement is to transfer those project activities that carry high risks to highly qualified individuals.

Risk Acceptance

When an organization accepts the risks involved in a project it is handling, it seeks collaboration with other entities to share or distribute the activities that are considered to be risky. The advantage of this risk response is that the organization can share those segments of the project it has no expertise to handle with a company experienced in the project task.

An organization can also choose this risk response by taking no action. When the probability of the risk happening is considered very low, or its impact is inconsequential, the organization may choose not to transfer, reduce or avoid the risk. It is, however, interesting to note that except for risk avoidance, all the other risk responses, including risk transfer and risk mitigation, embrace risk acceptance.

Example of Risk Acceptance vs. Transfer

An example of Risk acceptance vs. Transfer is best explained by a company that faces a risk of an estimated $20,000, yet the total cost of implementing any other risk response is above $40,000. The company, therefore, chooses to accept the risk rather than mitigate it since it is much cheaper. Risk transfer in this scenario would entail bringing in a third party to cover the cost of the risk when it happens and the company paying premiums for the cover.

After planning risk responses you will have residual risks, as well as those that have been deliberately accepted

Risk Escalation

This risk response strategy is most suitable when the sponsors and members of the project team agree that the risk presented is beyond the project scope. In this case, the project manager will escalate the matter to the project owner regarding the opportunity. (PMBOK®, 6th edition, ch. 11.5.2.5).

Example of Risk Escalation vs Transfer

An example of risk escalation is a case where a junior staff identifies an opportunity to introduce a new product into the company’s production. The opportunity is escalated to the senior management to decide. In risk transfer, the company would enter into a contractual agreement with another company to implement the idea on behalf of the organization.

Risk Transfer

Risk transfer is a type of risk response whereby the project owner shifts the risk to a third party. It entails the payment of some amount to the third party to offer a cover for the risk. It does not eliminate or reduce the probability of occurrence but only transfers responsibility. There are several ways in which risk transfer is implemented in organizations. These include insurance whereby the company purchases a cover for the risk and pays monthly premiums as a financial obligation to the third party.

Another way to implement risk transfer is through contractual agreements using the indemnification clauses. The main aim of risk transfer as a way to respond to risk is to reduce the extent of loss in case the threat becomes a reality or reinstate the company to its initial position before the risk occurred.

Positive Risk Response for Opportunities

Exploitation of Opportunity

There are instances where the project risk may bear positive results even though this may not be within the agreed thresholds. In such scenarios, the organization may choose risk exploitation as its preferred method of risk response. It will therefore have to effect strategies to take hold of the beneficial effects of uncertainty.

Risk exploitation may also entail modifying some of the project thresholds to gain the advantages presented by the overall project risks. Taking this direction would mean putting everything into place to increase the probability of the risk. However, it is important to carefully consider the overall outcome of exploiting the risk presented by a portion of the project tasks against the larger expectation.

Risk Sharing vs Transfer

The difference between risk transfer and risk-sharing is that while risk transfer involves transferring the responsibility of project risk to a third party through an avenue such as insurance or contractual agreements, risk-sharing involves two or more individuals or companies dividing or sharing the common risk. Risk sharing in most cases is highly successful in cases of opportunities.

Transferring Risks FAQ

Conclusion on Transferring Risk

Risk transference is one of the most practiced risk responses among large corporations. Although a single company may choose to implement different strategies based on the nature or value of the risk, there is no one-fit-all risk response. It is important to conduct continued risk monitoring to understand the nature of the risk response strategy that best suits your situation.