The success of a project is highly dependent on the ability of the management team to avoid or control exposure to risk. Implementing effective strategies towards minimizing or eliminating exposure to risk can lead to the elimination of unwanted expenses and business continuity.

What is risk exposure?

Risk exposure refers to the process of quantifying the potential loss that may arise from planned or ongoing activities in a project. (PMBOK®, 6th edition, ch. 11.2.3.2).

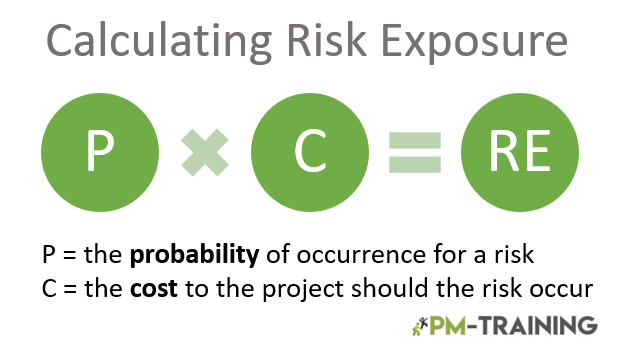

To calculate risk exposure, you multiply the risk impact by the probability of a risk occurrence.

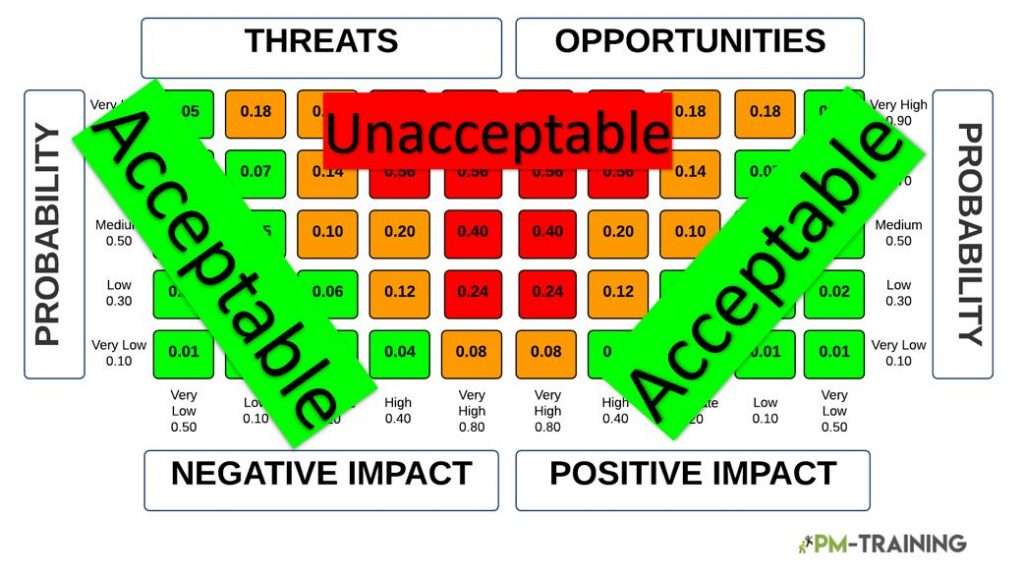

Risk exposure ranks different types of losses and the probability of their occurrence. After this, you can be able to determine acceptable and unacceptable losses. Some losses include property damage and loss, legal liability, and payments to recover a project from cybercrime.

Some of the methods which a company, business, or organization can use to control risk exposure include:

- Risk transfer. This technique refers to the organization transferring risk to outside parties. It may be a third party or through insurance.

- Risk avoidance. A company changes its decision to avoid oncoming risks.

- Risk-retention. This method refers to the acceptance of risk as part of the project and operations by a company

- Risk mitigation. An organization takes charge and controls the process to avoid risk or reduce risk in different sectors.

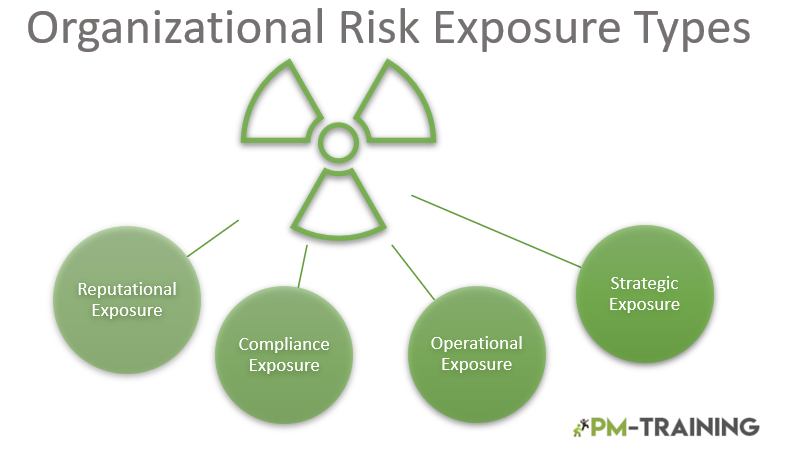

Types of Organizational Risk Exposure

Risks can affect the business aspect of the firm or its financial facet. Business risk is a threat that impedes the execution of the business model and goals and the business’s ability to cater to operating costs.

On the other hand, financial risk is a threat that affects the organization’s ability to manage debt and maximize capital gains.

There are four significant types of Risks that an organization can face.

- Strategic Risk – A strategic risk occurs when a firm does not implement the set plan to maximize profit.

- Operational Risk – While conducting procedures in an organization, time is an asset, and delay could lead to failure. As such, operational risk is a result of postponing daily routines in a firm

- Compliance Risk – Large firms are subject to regulatory authorities. Failure to comply with laws attracts penalties and legal cases. It may prove challenging to manage these risks when a company expands, leading to material loss and finances.

- Reputational Risk – Reputation risk is a threat that affects the influence or name of an organization. It leads to a loss in customer base to competing firms. It may cause loss of value and closure of business.

Identifying Risk Exposure

There are several ways in which you can identify risks. The first is by interrogating experts and leaders in the field and various stakeholders. These groups have experience from similar projects and will point you in the right direction.

You can also consult with the project team. Enquire from the team members if they see any potential risk. Brainstorm and identify events that may delay or drain the project resources. Have a draft of project assumptions by writing and filing them.

Study through the assumptions and verify them as they are part of your project’s foundation. Have a risk register that has a checklist of common risks. It should also include a response plan, risk priority level, owner and severity of risk, and likelihood.

Categorizing Risks

Risk categorization is identifying the threats to an organization based on their sources (PMBOK®, 6th edition, ch. 11.3.2.5). This process allows a business to identify areas that are prone to risks. Risks can be categorized mainly into two.

Internal Business Risks

A business can sabotage its functions leading to failure. Internal business risk refers to factors within the organization that prevent the organization from achieving its goals. Examples of such include lack of resources and innovation, mismanagement, poor structure, and business instability.

External risks

Anything that impacts the business but is out of the firm’s control is an external link. Change of clients, statutory and state regulation, market state, and suppliers are external risks.

Calculating the Level of Risk Exposure

Calculating the level of Risks follows a specific formula. You will need to gather information concerning the total loss if the risk becomes a reality and figure the probability of the risk happening. With this information, you can apply the risk exposure formula that requires you to multiply the two.

For instance, if the organization plans to buy equipment worth $20000 and pays for it beforehand. If the supplier only supplies equipment worth $10000, and the risk probability is 0.5, the total loss is $10000. Multiply $10000 by 0.5 to obtain a risk exposure of $5000.

Determining Risk Appetite With Thresholds

Risk appetite refers to the levels and parameters of risk an organization identifies and is prepared to accept in pursuit of its goals. It is also known as target risk. Risk appetite is a process that allows departments to set measures that manage risks.

When determining risk appetite regarding thresholds, you will need to access the level acceptable for the overall risk exposure of a project. When determining the risk appetite of an organization using thresholds is guided by the long-term and short-term objectives.

When determining the risk appetite, ensure that the governing entities of the organization align themselves with results that are acceptable to the firm. Ensure that there is a plan to evaluate the risk appetite statement if the business undergoes significant changes.

Communicate the unacceptable outcomes to relevant sources. Additionally, set up communication channels where people can enquire before the occurrence of a risk.

There is no universal standard that can measure an organization’s risk appetite. It varies from business to business and demands that the leaders consider the overall goals and individual events. The risk appetite depends on the degree of risk exposure, also known as the threshold.

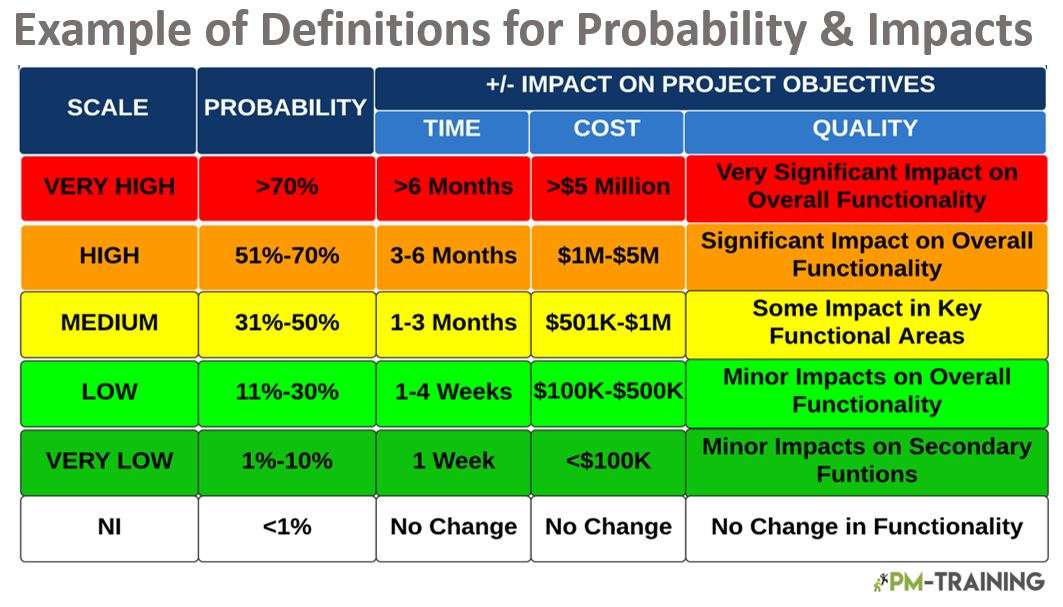

Risk Probability and Impact Matrix

Risk probability refers to the frequency of a risk occurring. On the other hand, the impact matrix provides insight into the effect of risk. The two concepts give information in the form of numbers. The higher the number, the higher the likelihood and impact of a project.

These two concepts in risk exposure are tools useful in the implementation of strategies. It also allows the organization to prioritize the strategies. The impact matrix measures the effort or ease of doing and completing a task versus the impact of the goal.

Next Step After Risk Exposure

After the risk exposure process, the project continues to the final cycle of the project. Though commonly neglected, project completion is an essential part of any business plan.

When the project comes to an end, hold a meeting to evaluate the success. Thank and acknowledge the effort of the team players. Ensure that all stakeholders are content with the outcome and procedures that were used.

It is essential to document the outcome for future reference and conduct a contract closure. The contract closure is a formal communication to the suppliers that their merchandise is accepted or rejected. The leaders close the project, release the team and make final payments. More info on Residual Risks Formula + Examples in Project Management